Dear Colleagues

I am pleased to attach the Economy / Market Snapshot covering all the major events in October, 2018.

Fall of the Indian market continued in October, 2018 with a loss of 5%. Nifty was about to go below 10,000 mark but bounced back to 10,400 levels. On the sectoral indices, Auto lost about 8% followed by IT 6%, FMCG 4% and Pharma 2%. Bank Nifty gained marginally. FII’s pulled out Rs.27,200 crores from equity market and Rs.9,300 crores from the debt market. Contrary to this, the Indian Mutual Funds pumped in Rs.21,900 crores in the equity market and Rs.28,300 crores in the debt market.

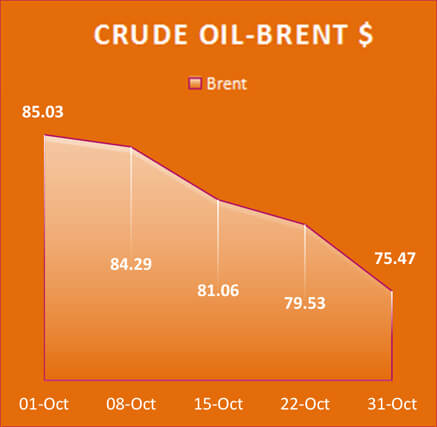

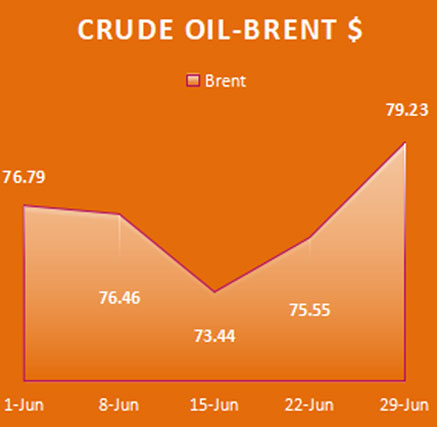

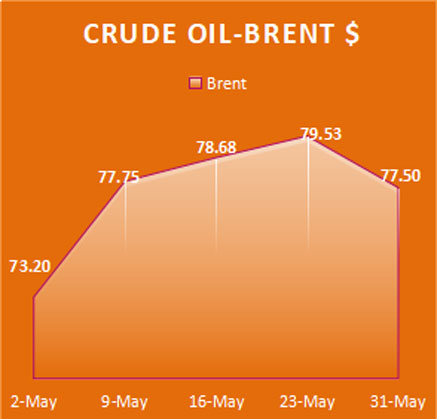

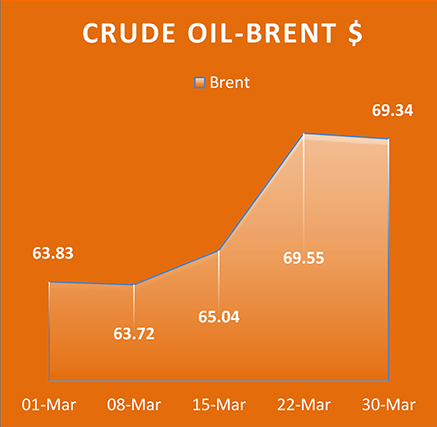

Global markets also went down last month with Hang Seng losing 10%, Nasdaq losing 9%, Nikkei losing 9%, Shanghai losing 8% and FTSE and DOW losing 5%. Indian Rupee crossed the Rs.74 mark and closed at Rs.73.95 to 1 US $. Gold gained by 4% while Silver lost about 1.5%. Much relief to India, Crude went down by 9% last month.

Q 3 results so far have been encouraging. Polls in 5 States will be held in November/December which is critical for the BJP and Congress. Actions from US on Iran will also be a major factor for India to watch. On the ILFS matter, the Government nominated Board has submitted a package to the NCLT while their Right Issue got a subscription of only Rs.5 lakhs with the existing investors staying away from the rights issue. FII’s have pulled out Rs.95,000 crores from the Indian market (both equity and debt) in this calendar year is not a good sign. The consoling factor is the domestic mutual funds have put in Rs.3,11,00 crores in the same period. Indian markets have lost over 11% in just 2 months and many of the stocks are trading at their 52 week low. Is this a time to buy or will this go for a further fall, am sure November will determine the course of direction and depending on the election results, we will see volatility in the markets in this calendar year.

Happy Diwali to each one of you and your family members and may the festival of lights bring in cheers and prosperity!

Regards

V Murali

General News

- Assembly polls: Madhya Pradesh and Mizoram will vote on November 28, Rajasthan and Telangana on

December 7; Chhattisgarh voting on Nov 12 and Nov 20. Counting for 5 states on December 11. - PM Modi meets Japanese counterpart Shinzo Abe; India, Japan ink six pacts, agree for 2+2 dialogue.

- India signs $5.4-billion deal to buy 5 S-400 missile systems from Russia during President Putin’s visit.

- Nirmala Sitharaman visits France for the first India-France Ministerial level annual defence dialogue.

- President Kovind visits Tajikistan; hold talks to strengthen India’s ties with the Central Asian country.

- Sushma Swaraj attends the Council of Heads of Govt Meeting of SCO in Tajikistan.

- Uzbek President Shavkat Mirziyoyev’s visits India; 17 MoUs inked for cooperation in various sectors.

- India and Croatia signs two agreements to facilitate cultural exchange & diplomatic cooperation.

- Cabinet approves MoU amongst BRICS nations regarding cooperation in the social and labour sphere.

- Statue of Unity: PM Modi unveils world’s tallest statue, credits Sardar Patel for united India.

- CBI Director Alok Verma, Special Director Rakesh Asthana divested of powers, sent on leave; MN Rao,

Joint Director at CBI appointed as the new interim Director. - SC gives CVC 2 weeks to complete inquiry against Verma, orders MN Rao not to take policy decisions.

- Sabarimala row: Devotees stop women from entering temple, SC agrees to review verdict on Nov 13.

- J&K municipal polls: Independents win 178 seats, BJP 100 and Congress 157 seats.

- Office-of-profit case: President Kovind dismisses plea to disqualify 27 AAP MLAs.

- Chief Secretary assault case: Delhi Court grants bail to Kejriwal, Sisodia and other 11 AAP MLAs.

- Farmers end 10-day Kisan Kranti Yatra march, claim victory after being allowed to enter Delhi.

- Madras HC upholds disqualification of 18 rebel AIADMK legislators.

- Jayalalithaa death probe: TN govt gives Justice Arumughaswamy Commission extension of 4 months.

- UP govt officially renames Allahabad to Prayagraj .

- Amritsar train accident: 61 dead as speeding train runs over crowd at Dussehra celebration.

- Justice Ranjan Gogoi sworn in as 46th Chief Justice of India.

- SC fixes 8pm – 10 pm for bursting crackers on Diwali, allows southern states to decide on 2-hour slot.

- SC allows deportation of seven suspected Rohingyas from Assam to Myanmar.

- Madras High Court orders CBI inquiry into corruption claims against Tamil Nadu CM Palaniswami.

- INX Media case: ED attaches Karti Chidambaram’s assets worth ₹54 crores in India, UK, Spain.

- ED files charge sheet against P Chidambaram in Aircel Maxis case.

- Bhima Koregaon violence: Bail plea of 3 activists rejected.

- Cyclone Titli wreaks havoc in Odisha, Andhra Pradesh; death toll touches 62.

- India witnesses biggest Zika virus outbreak as 105 test positive in Jaipur.

- India’s 2018 monsoon rainfall below average and forecast: IMD.

- Rafale Deal: Centre submits decision-making details in sealed cover to SC.

- BrahMos Aerospace engineer arrested for allegedly leaking information to Pakistan.

- Mike Pompeo visits China amid worsening ties over trade friction.

- North Korea agrees to allow inspectors into nuclear testing site: Mike Pompeo.

- South, North Korea agree to reconnect roads, rail amid US concern over easing sanctions.

- Brett Kavanaugh sworn in as US Supreme Court Justice after divisive fight.

- Nikki Haley resigns as US Ambassador to the UN.

- Explosive devices mailed to Obama, Hillary Clinton, others prompt security scare.

- Saudi confirms Jamal Khashoggi was killed in ‘brawl’ inside Istanbul consulate, King fires top officials.

- Interpol chief resigns amid detention in China.

- Chinese Premier Li Keqiang and Japan’s Abe announce China-Japan deals, commit to stable relations.

- EU workers moving to UK post-Brexit need visas, skills: British PM Theresa May.

- Sri Lankan President Sirisena sacks Ranil Wickremesinghe, appoints Mahinda Rajapaksa as new PM.

- Malaysia charges former PM Najib Razak, ex-Treasury head in graft probe.

- South Korea jails former President Lee Myung-bak for 15 years on corruption charges.

- Afghanistan votes for a new Parliament, terror attacks leave 170 dead.

- Maldives Supreme Court upholds President Abdulla Yameen’s vote defeat.

- Indonesia tsunami and quake: Death toll reaches 2,256; inflicts $911 million in losses.

- Indonesia’s Lion Air flight carrying 189 passengers crashes off near Sumatra.

- World’s longest 55 km sea-crossing bridge opens in China, connects Hong Kong to the mainland.

- Earth has 10 years left to avoid ‘unthinkable damage: UN climate report.

- Congolese Doctor Denis Mukwege and Yazidi Activist Nadia Murad awarded Nobel Peace Prize.

- 2018 Asian Para Games: India record best-ever medal haul, placed at ninth with 72 medals.

- Youth Olympic Games: India ends at 16th spot with 13 medals.

- World Wrestling Championship: Bajrang Punia settles for Silver, Pooja Dhanda wins bronze.

- Asian Hockey Champions Trophy: India shares title with Pakistan as finals called off due to heavy rain.

- India vs West Indies: India lead the 5-match series 2-1.

- India tops ICC Test team rankings; Virat Kohli, Rohit Sharma maintain top spots among ODI batsmen.

- Virat Kohli completes 10,000 ODI runs, beats Sachin Tendulkar to become fastest to reach milestone.

- FIFA rankings: Belgium overtakes France for the top spot, while Germany drops to 14th position.

Business News

- RBI maintains a status quo in October policy, keeps repo rate unchanged at 6.50%.

- Govt cuts excise duty on fuel by ₹1.50; oil marketing companies (OMCs) to absorb ₹1.

- Govt raises import duties up to 20% on 17 items, list includes smart watches, telecom equipment.

- Fiscal deficit touched 95.3% of 2018-’19 target in April-September: Govt.

- Manufacturing activity strengthens in September, PMI rises to 52.2 from 51.7 in August.

- Costlier food, fuel push September wholesale inflation to 2-month high of 5.13% vs 4.53% in August.

- India, Japan sign $75 billion currency swap agreement.

- SEBI empanels KPMG, Deloitte, 7 others to conduct forensic audit of listed companies.

- NSE enters commodity derivatives trading business with gold and silver contracts.

- NITI Aayog launches guidelines for Public-Private partnership in NCDs.

- International Finance Corporation launches $1 billion masala bonds to aid India investments.

- No mobile number will be disconnected, go for fresh KYC to delink Aadhaar: Telecom Dept.

- IDBI Bank allots 33.98 crore shares to LIC, stake increases to 14.89% post preferential allotment.

- Bank of Maharashtra shuts 51 branches for cost cutting.

- RBI sticks to Oct 15 deadline for data localisation.

- NCLT allows govt to take control of IL&FS; Uday Kotak, ICICI Bank’s GC Chaturvedi named on new board.

- RBI lays out rules to make seamless payments between different mobile wallets.

- FERA violation: Delhi court orders attachment of Mallya’s properties in Bengaluru.

- PNB case: ED attaches ₹637 crores worth of assets of Nirav Modi, over ₹218-crore assets of Mehul Choksi.

- India Mobile Congress 2018 discusses India’s road to 5G development.

- IBM acquires Red Hat in deal valued at $34 billion.

- Domestic passenger vehicle sales rose 6.88%, Domestic car sales grew by 6.8% in Apr-Sep: SIAM.

- Canada agrees to join US and Mexico on new trade deal to replace NAFTA.

- China’s Central Bank cuts reserve requirement ratio for fourth time this year.

- China, Japan sign bilateral currency swap deal of up to $30 billion.

- Reliance acquires 58.92% stake in Den Networks, 51.34% share in Hathway.

- IRDA makes long-term personal accident insurance optional.

- Ford sets up China business as a stand-alone unit.

- Govt unveils Digi Yatra, facial recognition system that allows entry into airports.

- India Energy Forum: Saudi Arabia commits to meeting India’s oil demand; keen to invest in downstream.

- Saudi Investment Summit: Saudi Arabia signs deals worth $56 billion.

- Qatar Petroleum signs 5-year LPG supply deal with China.

- Facebook shareholders back proposal to remove Mark Zuckerberg as Chairman.

- Alphabet shuts down Google+ after 5 lakh users’ data breached.

- WhatsApp builds system to comply with India’s payments data storage norms.

- Paytm launches ‘PayPay’ mobile wallet in Japan in JV with SoftBank, Yahoo Japan.

- Amazon in talks to buy 7-8% stake in Kishore Biyani’s Future Retail for ₹2,486 crores.

- US retail giant Sears files for bankruptcy.

- OYO expands international presence; forays into UAE and Indonesia.

- Govt allocates ₹144 crores to AYUSH ministry for alternative medicines.

- Dr Reddy’s sells US antibiotics manufacturing facility to UAE’s Neopharma.

- All patients fitted with Johnson & Johnson’s faulty hip implants can claim compensation: Panel.

- Zydus Wellness co jointly with Cadila Health propose to acquire Heinz India for ₹4,595 crores.

- IMF cuts world economic growth forecasts for 2018 and 2019 to 3.7% from 3.9%; projects India’s growth

rate at 7.3% in 2018, 7.4% in 2019. - US budget deficit hits $779 billion in Trump’s first full fiscal year.

- UK inflation drops more than expected in Sept, pulled down by food prices.

- India 58th most competitive economy in WEF index, rank up 5 places over 2017, US tops the list.

- Financial Action Task Force finalises report with recommendations for de-listing Pakistan from grey list.

- Chanda Kochhar quits ICICI Bank, board appoints Sandeep Bakhshi as MD, CEO for 5 years.

- Arundhati Bhattacharya join the boards of Reliance Industries and Wipro.

- IMF appoints Harvard professor Gita Gopinath its first woman Chief Economist.

- Sunil Bhaskaran appointed as AirAsia India head; Tony Fernandes & Bo Lingam step down.

Q2 Results

- HDFC Bank’s Q2 profit rises 20.6% to ₹5,005 crores, Provisions and contingencies up 23% to ₹1,820 crores.

- ICICI Bank Q2 profit tanks 55.84% to ₹908.88 crores, asset quality improves, GNPA lower at 8.54%.

- Yes Bank Q2 profit falls 3.8% to ₹964.7 crores, NII increased 28.2% to ₹2,417.55 crores.

- Canara Bank Q2 profit rises 5% to ₹299.5 crores as asset quality improves, GNPA down at 10.56%.

- IndusInd Bank Q2 profit rises 4.56% to ₹920.25 crores, GNPA fell to 1.09% and NNPA declined to 0.48%.

- Federal Bank Q2 profit grew by 0.9% YoY to ₹266 crores, GNPA increased to 3.11%, NNPA higher at 1.78%.

- Infosys Q2 profit up 13.8% to ₹4,110 crores, revenue up by 7.7%; announces dividend of ₹7/share.

- Tech Mahindra Q2 profit jumps 27% to ₹1,064 crores, revenue increased to ₹8,629.85 crores.

- Mindtree Q2 profit grows 30.4% to ₹206.3 crores, revenue grew by 7.07% to ₹1,755.4 crores.

- TCS profit up 22.57% to ₹7,901 crores; revenue up at ₹36,854 crores, announces dividend of ₹ 4/share.

- Tata Motors posts Q2 loss of ₹1,049 crores on lean JLR sales, revenue climbed to ₹71,293 crores.

- Maruti Suzuki Q2 profit falls 10% to ₹2,240 crores, revenue rises 3% to ₹22,433.2 crores.

- Bajaj Auto Q2 profit rises 4% YoY to ₹1,152 crores, revenue grew 21.63% to ₹7,986.79 crores.

- HUL Q2 profit jumps 23% YoY to ₹1,522 crores, revenue comes at ₹9,138 crores.

- ITC Q2 profit rises 11.92% YoY to ₹2,954.67 crores, revenue increased 7.3% to ₹11,069 crores.

- L&T Q2 profit rises 22.53% YoY to ₹2,230 crores, revenue grew 21% to ₹32,081 crores.

- RIL Q2 Profit soars 17.4% YoY to ₹9,516 crores, revenues increased by 54.5% YoY to ₹1,56,291 crores.

- BHEL Q2 profit jumps 60.43% to ₹185.17 crores; revenue grew by 6.34% YoY to ₹6,779.88 crores.

- Hindustan Zinc Q2 profit falls 29.5% at ₹1,815 crores; declares interim dividend at ₹20/share.

- Dr Reddy’s posts 77% rise in Q2 net profit at ₹503.8 crores, revenue rose 7% to ₹3,797.8 crores.

| WORLD INDICES | |||||

|---|---|---|---|---|---|

| Indices | 31-Oct | 28-Sep | % 1M | 01-Jan | % since Jan |

| BSE | 34442 | 36227 | -4.93% | 33813 | 1.86% |

| NSE | 10387 | 10930 | -4.98% | 10436 | -0.47% |

| DOW | 25116 | 26458 | -5.07% | 24719 | 1.60% |

| NASDAQ | 7306 | 8046 | -9.20% | 6903 | 5.83% |

| FTSE | 7128 | 7510 | -5.09% | 7688 | -7.28% |

| Nikkei | 21920 | 24120 | -9.12% | 22765 | -3.71% |

| Hang Seng | 24980 | 27789 | -10.11% | 29919 | -16.51% |

| Straits Times | 3019 | 3257 | -7.31% | 3403 | -11.29% |

| Shanghai | 2603 | 2821 | -7.75% | 3307 | -21.30% |

| USD | 73.95 | 72.44 | 2.08% | 63.68 | 16.14% |

| Euro | 83.89 | 83.89 | 0.00% | 76.48 | 9.69% |

| GBP | 95.00 | 94.54 | 0.48% | 86.06 | 10.39% |

| Yen/100INR | 0.66 | 0.64 | 2.57% | 0.56 | 15.99% |

| Gold | 31760 | 30508 | 4.10% | 29123 | 9.05% |

| Silver | 38048 | 38600 | -1.43% | 39176 | -2.88% |

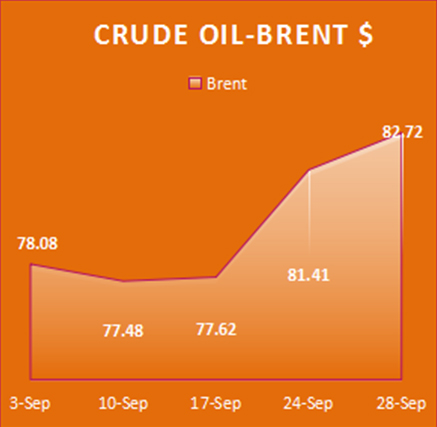

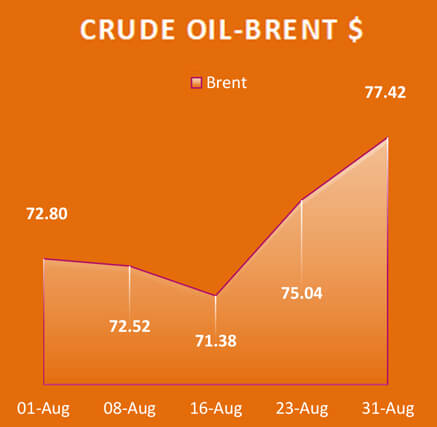

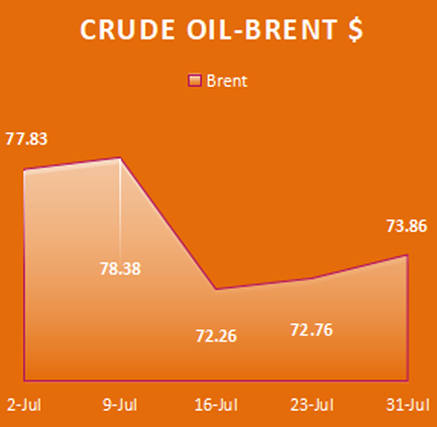

| Crude Brent $ | 75.47 | 82.72 | -8.76% | 67.13 | 12.42% |

| Crude Nymex $ | 65.14 | 73.25 | -11.07% | 60.62 | 7.46% |

| NIFTY SECTORAL INDICES | |||||

|---|---|---|---|---|---|

| Sectors | BANK NIFTY | CNX IT | CNX AUTO | CNX FMCG | CNX PHARMA |

| 31-Oct | 25153 | 14940 | 8821 | 28547 | 9758 |

| 28-Sep | 25120 | 15838 | 9590 | 29758 | 9972 |

| % 1M | 0.13% | -5.67% | -8.03% | -4.07% | -2.16% |

| 01-Jan | 25318 | 11566 | 11891 | 26686 | 9618 |

| % since Jan | -0.65% | 29.18% | -25.82% | 6.97% | 1.45% |

| INDIAN TRADE(USD MILLION) | |

|---|---|

| Exports | 27950 |

| Imports | 41930 |

| FDI | 1898 |

| Government Bond 10Y | 7.85% |

| GDP YoY | 8.20% |

| Inflation Rate | 3.77% |

| Forex Reserves $ M | 393520 |

| IIP % | 4.30% |

| INSTITUTIONAL TRADING ACTIVITY | ||

|---|---|---|

| Particulars | FII (Rs.crore) | MF (Rs.crore) |

| Equity | (27223) | 21886 |

| Debt | (9309) | 28332 |

| Total 1 M | (36532) | 50218 |

| Total Since Jan | (95455) | 311882 |

| Equity | (36845) | 103357 |

| Debt | (58610) | 208525/td> |