Dear Colleagues,

I am pleased to attach the Economy / Market Snapshot covering all the major events in April, 2016.

Indian markets were stable last month. With the Parliament session on, market has shown some bit of nervousness. FII’s continued to place their bets in the Indian market – investment of Rs.6,000 crores in both equity and debt markets. Indian Rupee was stable and hovering around Rs.66.33 mark. Bank stocks shot up in anticipation of results but the results of Axis Bank, ICICI Bank were not upto the expectations. Price of Yes Bank shot up and nearing Rs.1000 level but we need to see the impact post results. Public sector banks will announce their results in May and hopefully we will see a large clean up in the banking system. Provisioning will be all time high is the general expectation. IT Companies – Infosys, TCS and Wipro came with better results while HCL Tech disappointed the market. Several states are going into elections and the results will be out in May which will determine the strength of BJP, Congress and some of the regional players like Trinamool, AIADMK, DMK etc

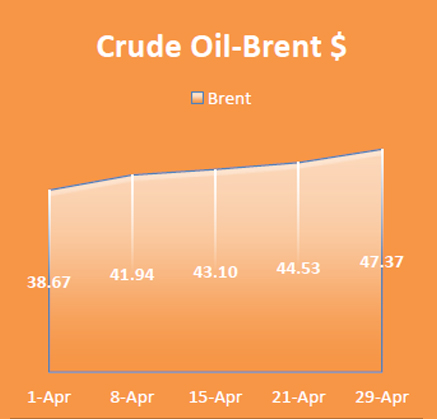

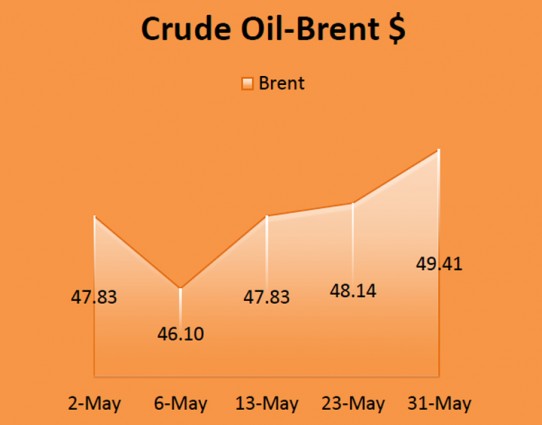

Globally markets were stable except the China market which went down by 2%. Gold and Silver prices have gone up consistently; Silver crossed the Rs.40,000 mark and Gold crossed the Rs.30,000 mark. Crude shot up to $ 46 a barrel, a rise of 18% over last month.

The IPL season is on ! Sad to see the erstwhile Chennai Superkings split into Pune led by Dhoni and Gujarat led by Raina. As of date, Dhoni’s team is not doing well but Raina’s team is on the Top of the table. The absence of Gayle has put in more pressure on Kohli and De Villiers to take Bangalore to Top. Currently they are also struggling and just lost a match last night to the Hyderabad Team. Warner is in good form and winning matches for Hyderabad. We will see the finals in the month of May.

Happy reading!

Regards

V Murali

General

- Panama Papers leak: World figures named in massive offshore tax evasion leak; Over 500 Indians

linked to offshore firms; I-T Dept sends notices to Indians named in expose. US has opened a criminal

investigation into tax avoidance schemes exposed by the Panama Papers. - Vijay Mallya case: Non-bailable warrant issued against Vijay Mallya by Mumbai Court. India writes to

UK, seeks Vijay Mallya’s deportation. He says he is in forced exile, wish to settle debt with banks. - Prince William, Kate Middleton visited India and Bhutan on a seven-day tour, aimed at building up

strong bonds with the two countries. - Gurgaon will now be called Gurugram.

- Modi’s Visit to Saudi Arabia further bolsters India’s engagement with the Kingdom.

- Agusta Westland: Government denies deal with Italian PM. Sonia rejects allegations linking her to

bribes in Agusta Westland deal. - India, China hold 19th round of talks to resolve border dispute.

- 2016 State Assembly Election: Heavy voting in West Bengal.

- Kollam temple fire: Atleast 114 were dead; Kerala to seek Rs 117 crores aid from centre.

- Monsoon to be above average; 94% chance of normal- excess rains: IMD.

- ISRO’s final navigation satellite IRNSS-1G blasts off from Sriharikota to give India its own GPS.

- India among 175 countries to sign historic Paris climate deal at UN.

- Mumbai-Ahmedabad bullet train to travel under the sea near Thane creek.

- Modi to visit U.S in June, likely to address Congress.

- Mehbooba Mufti becomes the first woman CM of Jammu and Kashmir.

- Modi launches ‘Stand up India’, says will empower Dalits, women.

- Nitish Kumar formally takes over as JD(U) president.

- OROP gets retrospective Cabinet nod.

- Yeddyurappa named Karnataka BJP president.

- Supreme Court orders common entrance test for MBBS, BDS and PG courses through NEET.

- PM to launch Rs. 8,000 crores scheme for free LPG connections to poor.

- Odd Even scheme: After Ola, Uber, auto aggregator Jugnoo suspends surge pricing in Delhi.

- Defamation case: Arvind Kejriwal, 5 other AAP leaders get bail.

- Lok Sabha session from April 25 to May 13.

- Uttarakhand crisis: President’s Rule in Uttarakhand to continue, rules Supreme Court.

- President Pranab Mukherjee confers Padma Awards 2016. Sri Sri Ravi Shankar, Late Dhirubhai Ambani,

Rajinikanth, Sania, Priyanka Chopra honoured with Padma awards. - Tamil Nadu election: AIADMK and DMK to contest 227,176 seats respectively; Congress joins hands

with DMK, to contest 41 seats. - China arrests 62 people in biggest telecom fraud.

- H1B visa caps met, lottery to select 85,000 petitions.

- Pathankot attack: Pakistan team wraps up its probe in India.

- India expects $500 million Asian Infrastructure Investment Bank loan for solar power projects in 2016.

- Modi, Cameron meet focused on defence, Make In India.

- Aadhaar to cross 100 crore mark, aims to boost government plans.

- Germany to give €500 million loan to Nagpur Metro.

- U.P. tops growth in enterprises, jobs; sees a 67.4 % growth in the number of establishments.

- Bihar bans liquor, becomes fourth dry state in India: Nitish Kumar.

- Bombay HC suggests BCCI to shift IPL matches out of drought-hit Maharashtra.

- National Herald case: Congress submits its balance sheet to court.

- Enforcement Directorate attaches Rs. 122 crores assets in lottery scam.

- BRICS moves to establish bank institute and rating agency; BRICS bank disburses $250 million loan for

renewable energy project to Canara Bank. - Earthquake kills 272 in Ecuador.

- Bombay High Court orders demolition of Adarsh Society building.

- Mary Kom named AIBA ambassador for Women’s World Championships.

- West Indies beat England to win World Twenty20

- BCCI appoints media veteran Rahul Johri as CEO.

Business News

- India’s forex reserves rises to $361.60 billion.

- RBI cuts repo rate by 25 bps to 6.5%; raises reverse repo, keeps CRR unchanged.

- External debt at the end of December 2015 up by $4.9 billion at $480.2 billion.

- India’s service activity accelerates in March, PMI highest since June 2014 at 54.3.

- March CPI seen easing to 5.05% MoM; Feb IIP may improve to 1.5%.

- Raguram Rajan launches the Unified Payments Interface to boost digital money transfers.

- India’s trade deficit narrowed to $5.07 billion in March.

- Government gives in to pressure, EPF interest rate increased to 8.8% from 8.7%.

- Foreign portfolio investors (FPIs) stay bullish on India, pump in $2 billion in April .

- New Income Tax Returns: taxpayers to disclose expensive assets.

- Mutual funds poorer by Rs 73,000 crores in March.

- China Q1 GDP growth seen at 6.7%, slowest since 2009.

- IMF predicts India’s GDP growth rate will be 7.5 per cent in 2016 and 2017.

- Bharti Airtel buys spectrum from Aircel for Rs. 3,500 crores.

- Vedanta Resources to buy back bonds worth up to $349 million.

- L&T expects defence orders worth Rs. 50,000 crores in 3 years.

- Huawei exceeds $60 billion revenue in 2015.

- Finance Ministry lines up 16 PSUs for disinvestment.

- Tax department issues refunds of over Rs 1.17 lakh crores.

- US judge approves $20 billion settlement for BP oil spill.

- Nita Ambani most powerful businesswoman in Asia.

- Centre to create a $1 billion equity fund for solar energy.

- Equity mutual funds add 43 lakh folios in FY’16.

- Adani’s $21.7 billion Australian Coal mine project gets approval.

- Banks stressed assets may touch Rs. 10 lakhs crores in Q4: Report.

- TCS to appeal against US jury’s $940 million notice.

- Bank deposit growth slowed to a five-decade low in FY16.

- Companies line up IPOs worth Rs. 15,000 crores.

- Government revives talks to revamp Factories Act.

- HDFC to sell 10% stake in life insurance arm via IPO.

- Intel to slash up to 12,000 jobs worldwide.

- Vodafone invites pitches from banks for India IPO.

- Mahindra & Mahindra becomes first Indian company to join EP100 campaign.

- RCom, RJio get government nod for sharing of spectrum in 9 circles.

- RIL lines up Rs 1.5 lakhs crores capital expenditure, mostly for Jio.

- Jet Airways’ shareholders approve JetLite merger.

- Volkswagen takes $18 billion hit over emissions scandal.

- Private equity deals in Jan-March jump to $2.96 billion.

- Govt plans to cut scrutiny time of tax returns to 1 year.

- Patanjali to invest Rs 1,150 crores in FY17, eyes doubling revenue .

- Telenor threatens to exit India; promises lowest tariff in 4G services

- Infosys co-founder Nandan Nilekani invests in RailYatri.

- Indra Nooyi, Satya Nadella, Bhavesh Patel among highest paid CEOs in world

- Airtel, Vodafone, Tata Teleservices seeking spectrum liberalisation.

Q4 Results

- Infosys beats market estimates; Q4 net up 16.2% at Rs 3,597 crores.

- TCS Q4 revenue growth marginally beats expectations.

- DCB Bank Q4 profit up 10%, NII jumps 30%; asset quality improves.

- LIC Housing Finance Q4 net up 20% at Rs. 1,667 crores.

- Wipro posts largely in-line quarterly numbers again, sets buyback of shares at premium.

- Reliance Q4 consolidated net rises 16% to ₹7,398 crores.

- HDFC Bank Q4 net profit jumps 20% to Rs. 3,374 crores to pay Rs. 9.50/share.

- BP first quarter earnings fall of 80 per cent, beat analyst estimates

- ACC Q1 net falls 4% at Rs 277cr, margins at 14.5%, volume up 9%.

- Vedanta reports Q4 net loss at Rs 11,181 crores.

- Bharti Airtel Q4 net up 2.8% at Rs 1,290 crores.

- HCL Tech Q3 below estimates; net up 0.3%, $ revenue up 1.3%.

- YES Bank Q4 net rises 27%; asset quality weak & provisioning up.

- Bharti Q4 net seen up 13%, Africa biz growth likely to be flat.

- ICICI Bank Q4 PAT tanks to Rs 702 crores on Rs 3,600 crores exceptional loss.

- Axis Bank Q4 net dips after 46 Quarters; net profit fell 1.22% to Rs 2,154 crores in the fiscal fourth quarter from Rs 2,180 crores a year ago.

- IndiGo’s profit zooms 53% in FY16.

Market News

- Indian markets went up by 1% last month

- Bank stocks went up by 4%, Auto and Pharma up bu 2.50% while IT went down by 1%

- Q 4 and FY 2015-2016 began with Infosys results beating expectations;

- FII’s have pumped in Rs.3600 crores in the equity market while Mutual Funds have invested Rs.35,500 crores in Debt markets

- FII’s have put in about Rs.22,500 crores in Indian Equity markets since January, 2016 despite sell off in January, 2016.

- World markets were stable – within a margin of 1% positive to 1% negative.

- Gold and Silver prices have started moving up; Gold up by 5% and Silver up by 13%

- US Dollar VS INR remained stable and ended at Rs.66.33

- Crude prices continue to rise and currently at $ 46 a barrel; Despite predictions that it will go as low as $ 5 a barrel, it shot up by 20% last month

- Private sector banks did not impress markets with their Q4 /FY results; Public sector banks will come out with their results in May which will set the direction for Banking Stocks

| WORLD INDICES | |||

|---|---|---|---|

| Indices | 04-29-2016 | 03-31-2016 | % 1M |

| BSE | 25,606 | 25,342 | 1.04% |

| NSE | 7,850 | 7,738 | 1.44% |

| DOW | 17,774 | 17,685 | 0.50% |

| NASDAQ | 4,775 | 4,870 | -1.94% |

| FTSE | 6,242 | 6,175 | 1.08% |

| Nikkei | 16,666 | 16,759 | -0.55% |

| Hang Seng | 21,067 | 20,777 | 1.40% |

| Straits Times | 2,839 | 2,841 | -0.09% |

| Shanghai | 2,938 | 3,004 | -2.19% |

| USD | 66.33 | 66.38 | -0.08% |

| Euro | 75.91 | 75.50 | 0.54% |

| GBP | 97.06 | 95.20 | 1.95% |

| Yen/100INR | 0.68 | 0.59 | 15.54% |

| Gold | 30,116 | 28,549 | 5.49% |

| Silver | 41,630 | 36,751 | 13.28% |

| Crude Brent $ | 47.37 | 40.33 | 17.46% |

| Crude Nymex $ | 45.92 | 38.07 | 20.62% |

| NIFTY SECTORAL INDICES | |||||

|---|---|---|---|---|---|

| Sectors | BANK NIFTY | CNX IT | CNX AUTO | CNX FMCG | CNX PHARMA |

| 03-29-2016 | 16795 | 11196 | 8289 | 19738 | 11293 |

| 03-31-2016 | 16142 | 11309 | 8088 | 19764 | 10989 |

| % 1M | 15.74% | -1.00% | 2.48% | -0.13% | 2.77% |

| INDIAN TRADE( USD MILLION) | |

|---|---|

| Exports | 22719 |

| Imports | 27790 |

| FDI | 2473 |

| Government Bond 10Y | 7.44% |

| GDP YoY | 7.30% |

| Inflation Rate | 4.83% |

| Forex Reserves $ M | 361600 |

| IIP % | -0.97% |

| INSTITUTIONAL TRADING ACTIVITY | ||

|---|---|---|

| Particulars | FII (Rs.crore) | MF (Rs.crore) |

| Equity | 3,671 | -273 |

| Debt | 2,437 | 35,506 |

| Total 1 M | 6,108 | 35,233 |

| Total Since Jan | 72,036 | 6,14,757 |

| Equity | 22,578 | 69,000 |

| Debt | 49,458 | 5,45,757 |

Sorry, the comment form is closed at this time.