Dear Colleagues

I am pleased to attach the Economy / Market Snapshot covering all the major events in February, 2019

Indian market was marginally down last month. Bank Nifty and FMCG stocks lost about 2% while IT and Auto stocks went up by 1.50%. FII’s invested about Rs.14,500 crores in in the equity market while Domestic Institutional Investors invested 5,700 crores. Indian Rupee closed at Rs.70.72 for 1 US $.

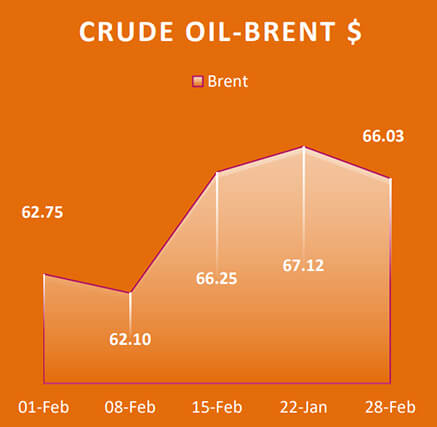

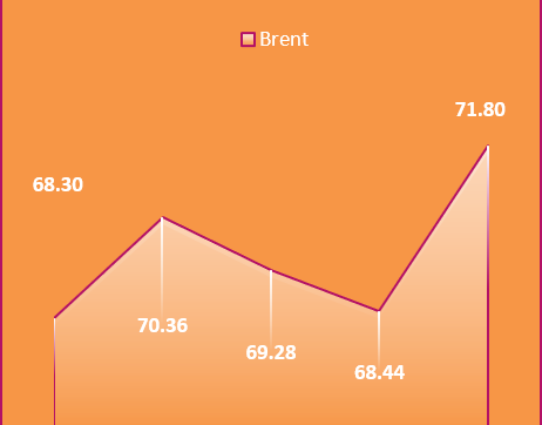

On the Global markets front, it was all GREEN last month. The Shanghai index gained about 14% with the news of potential settlement of the trade disputes with US. US markets went up by 3.50%, London market went up by 1.50% and Japan and Hong Kong going up by 3%. Gold was marginally down while Silver lost about 3%. Crude continued its upward journey and moved up by 7% to trade at $66 a barrel.

February was an actioned packed month for both India and US. As we expect the safe arrival of Abhinandan today, the tension between Pakistan and India has not eased. With the elections to be notified in March, politics is taking center stage in every action. The interim budget was passed. The Government also issued an ordinance banning unregulated deposits. This would have very wide implications for business as there are restrictions of moving funds from one entity to another entity (there are also exclusions) – be it Company, Partnership, LLP, Sole Proprietorship or Individuals. This has come into effect from 21st February, 2019 and one has to carefully go through this important ordinance before venturing into any inter-company transfers or loans or deposits.

On the Global front, Trump declared emergency to construct the wall which is being challenged. Trump extended the deadline of 1st March for new tariffs on Chinese imports. He has also tweeted that the trade talks are progressing very well and he is likely to meet the Chinese President soon in a summit. The much awaited summit between US and North Korea concluded yesterday without much progress.

We will see some volatility in markets in March. Let us keep our fingers crossed to see positive developments.

Happy reading!…….

Regards

V Murali

General News

- 40 jawans killed as an explosive-laden vehicle ram into a CRPF convoy in J&K’s Pulwama district; JeM claims responsibility.

- India avenges Pulwama attack, IAF’s 12 Mirage fighter jets hits terror camps in PoK.

- Pakistan violates Indian Air Space in J&K; India retaliates, MiG 21 crashes and IAF’s Pilot lands in Pakistan.

- Pakistan PM Imran Khan says IAF Pilot to be released on March 1 as peace gesture.

- Pulwama attack mastermind killed in encounter; Jaish leadership in Valley eliminated: Army.

- Maharashtra: BJP and Shiv Sena seal deal for 2019 LS elections; to contest in 25, 23 seats respectively.

- Tamil Nadu: DMK gives 10 seats to Congress; ruling AIADMK seals alliance with BJP, gives 5 seats.

- Mayawati, Akhilesh Yadav announce seat-sharing for Uttar Pradesh, Madhya Pradesh and Uttarakhand.

- 1,599 cases of ceasefire violations along LoC in 2018; 20 jawans killed.

- PM Modi inaugurates first-ever university in Ladakh; lays foundation stone of two hydro-power projects & AIIMS in Jammu.

- PM Modi launches several development projects in Bihar, Arunachal Pradesh, Uttarakhand, Haryana.

- Nitin Gadkari inaugurates and lays foundation stone of several infra projects in Odisha, Himachal Pradesh.

- PM Modi flags off engine-less Vande Bharat Express, world’s first diesel to electric locomotive in Varanasi.

- Rajnath Singh launches single emergency helpline ‘112’ for 16 states and Union Territories.

- Nirmala Sitharaman launches Coast Guard patrol vessel, asks defence PSUs to expand market.

- Rajya Sabha Budget session ends, CAG Rafale report tabled, citizenship and triple talaq bills not presented.

- Saudi Crown Prince, PM Modi hold bilateral talks; India- Saudi Arabia sign 5 MoUs in various areas.

- PM Modi visits South Korea; India, S Korea sign 7 pacts; PM gets Seoul Peace Prize, gives $200,000 prize money to Namami Gange fund.

- Prince of Monaco Albert II, Argentina President Macri hold talks with PM Modi on their respective visits.

- Sushma Swaraj attends Russia-India-China trilateral meet in Wuzhen, China.

- New Rafale deal 2.8% cheaper than UPA agreement; flaws in acquisition of Apache, Chinook helicopters:CAG report.

- Defence Minister Nirmala Sitharaman flags off Aero India 2019 in Bengaluru.

- West Bengal CM Mamata Banerjee ends her dharna over the CBI’s action against Kolkata police Chief.

- AAP Opposition Rally: AAP chief Arvind Kejriwal hosts anti-BJP rally; over dozen of parties turn up.

- Puducherry CM Narayanasamy calls off his sit-in protest after LG Kiran Bedi agrees to terms.

- Nagaland govt passes resolution against citizenship bill.

- Govt picks IPS Rishi Kumar Shukla as new Director of CBI.

- UK government signs extradition order of Vijay Mallya to India.

- Delhi govt vs LG: SC rules in favour of LG in 4 of 6 issues; refers power of ‘services’ to larger bench.

- Kolkata Police Chief transferred after interrogation by the CBI in connection with the Saradha scam case.

- Robert Vadra appears before ED for questioning.

- Kulbhushan Jadhav case: India and Pakistan face each other at the ICJ in a 4 day public hearing.

- Mayawati has to reimburse the public money spent on her statues, party symbol: SC.

- SC stays the order of forced eviction of more than 1 million tribals, forest-dwellers across 16 states.

- Sabarimala review pleas: SC reserves order, temple board says will respect verdict.

- Two-leaves symbol goes to EPS-OPS’s AIADMK: Delhi HC.

- India’s 40th Communication Satellite, GSAT-31, successfully injected into orbit.

- Trump delivers State of the Union address; immigration, trade, N Korea and Russia on the agenda.

- Trump declares national emergency to get $8 billion for wall; House passes resolution to revoke order.

- Trump signs order to create US Space Force, to handle threats in Space.

- Afghan peace talks: Taliban co-founder meets top White House envoy.

- Saudi Crown Prince signs $20 billion in agreements with cash strapped Pakistan.

- China to provide $2.5 billion loan to Pakistan to boost foreign cash reserves.

- US-North Korea 2nd summit: Kim-Trump nuclear talks end with ‘no agreement’.

- British MPs back vote on delaying Brexit if May’s deal fails to win majority.

- Venezuela in crisis: Juan Guaido, leader of the opposition, declared himself interim President.

- Former Maldives President Abdulla Yameen arrested over money laundering.

- Pope Francis embarks on historic visit to UAE.

- India vs New Zealand: India wins ODI series 4-1; New Zealand clinch T20 series by 2-1.

- India vs Australia: Australia clinch T20 series 2-0.

- ICC ODI Rankings: England retain top spot followed by India as New Zealand climbed to third spot.

- ICC T20 rankings: Kuldeep claims 2nd spot; Pakistan top-ranked team, India 2nd.

- IPL 2019 is set to kick-off on March 23, final to be held in Chennai.

Business News

- Piyush Goyal presents Modi govt’s interim Budget ahead of the Lok Sabha elections.

- Govt revises FY19 fiscal deficit target at 3.4% of GDP from 3.3%, FY20 pegged at 3.4%; FY20 divestment target increased by 12.5% to ₹90,000 crore.

- Tax exemption for income up to ₹5 lakh per year; Standard Deduction raised from ₹40,000 to ₹50,000.

- Capital gains exemption under Sec 54 increased to ₹2 crore, to be available on 2 house properties.

- Pradhan Mantri Shram Yogi Mandhan: Unorganised sector workers to get ₹3,000 post-retirement.

- RBI cuts lending rate by 0.25% to 6.25%, changes policy stance to ‘neutral’; projects GDP growth at 7.4%.

- RBI pays ₹28,000 crore as interim dividend to govt for second successive year.

- 33rd GST Council meeting: Tax rate for under-construction housing lowered to 5% from 12%.

- Niti Aayog delegation led by Amitabh Kant visits Saudi Arabia, Invest India grid launched.

- Indian economy set to reach $5 trillion: PM Modi launches India Korea startup hub in Seoul.

- Cabinet approves new National Electronics Policy, aims to generate 1 crore jobs.

- Govt cuts ₹3 crore from FY20 allocation for Startup India programme.

- Govt relaxes angel tax norms, expands the turnover criteria, widens age cap of startups from 7 to 10 yrs.

- Govt to infuse ₹48,239 crores in 12 PSU banks.

- Bengal Global Business Summit 2019: 86 MoUs signed with a commitment to invest ₹2.84 trillion.

- Finance Ministry spent ₹1,157 crore extra in 2017-18 without obtaining prior approval: CAG.

- Britannia to replace HPCL in the Nifty50 from March 29.

- RBI clears Yes Bank of any divergences in bad loan reporting practices.

- RBI extends KYC deadline for e-wallets by 6 months.

- CBI issues lookout notice against Chanda Kochhar, 2 others in ICICI loan case.

- Ericsson case: Anil Ambani found guilty of contempt, asked to pay dues in 4 weeks or face jail time.

- Reliance Capital offers to sell 43% stake in asset management firm to Nippon life insurance.

- RComm seeks lenders approval to release ₹260 crores to Ericsson; Reliance group seeks to sell up to 30%

- stake in Reliance Power, hires bankers for stake sale.

- Andhra Pradesh to get 10 lakh electric vehicles in 5 years, ban on diesel and petrol cars.

- Daimler India reaches break-even in truck business; achieved 35% growth in 2018.

- Nissan cancels investment plan for UK plant.

- Honda to close its UK plant in 2022, cutting 3,500 jobs. Decision not Brexit related: CEO.

- Government provides a token amount of about ₹1 lakh as budgetary support to Air India.

- Etihad infuses ₹252 crore in Jet Airways; SBI, PNB mulls ₹550 crore emergency funding.

- Jet Airways gets shareholders’ approval for conversion of loan into shares.

- GVK Airport holdings acquires 13.5% more stake in Mumbai airport.

- Air passenger traffic growth for the month of January comes in at 53-month low of 9.1%.

- IRCTC launches its own payment aggregator system called IRCTC iPay.

- NCLAT allows 22 IL&FS firms to pay debt; approves Justice DK Jain for resolution process.

- Indian Oil signs first annual deal to buy up to 3 million tonnes of US oil.

- Dubai’s ENOC partners with Indian Oil to expand abroad.

- Government allows export of bio-fuels from special economic zones, EoUs.

- SC refuses to allow reopening of Sterlite plant in Tamil Nadu, asks parties to approach Madras HC.

- NASSCOM ends annual growth forecast, sector has grown 9.2% in 2018-19, against a forecast of 7-9%.

- Tech Mahindra announces first ever share buyback at 14.59% premium for ₹1,956 crores.

- Cognizant agrees to pay $25 million to settle SEC’s bribery charge.

- Lava expands operations in Africa, entering Ghana, Kenya, and Nigeria.

- Samsung launches Galaxy Fold, the first 5G foldable smartphone.

- Qualcomm urges US regulators to reverse course and ban some iPhone models.

- Sony announces its first ever share buyback of 100 billion yen ($910 million).

- Amazon drops New York headquarters plan amid protests.

- Parliamentary panel summons Facebook officials over citizens’ rights protection.

- Facebook ramps up efforts to make elections ads more transparent.

- Flipkart co-founder Sachin Bansal invests ₹650 crore in Ola.

- Daimler, BMW to invest €1 billion in venture to rival Uber.

- China’s Didi Chuxing invests $100 million in Oyo.

- PepsiCo divests West and South bottling franchise to Varun Beverages.

- Emami promoters sell 10% stake for ₹1,600 crore; PremjiInvest, IDFC & others pick up stake.

- India’s trade deficit widens to $14.73 billion in January.

- India exports to China touches $12.7 billion in Apr-Dec: Commerce Ministry.

- India hikes customs duty on goods from Pakistan to 200% after Pulwama terror attack.

- Trump delays tariff hike on Chinese goods as trade talks progress; may meet Xi Jinping to seal pact.

- China’s state agricultural body COFCO buys million-tonne batch of US soybeans.

- Air India Chief Pradeep Singh Kharola has been appointed as Civil Aviation secretary.

- Apple retail chief Angela Ahrendts to depart in April, Deirdre O’Brien named SVP of Retail + People.

- Former Pepsi CEO Indra Nooyi appointed Amazon Board Member.

- Twitter Co-Founder Evan Williams steps down from Board after 12 years.

Q3 Results

- IDBI Bank Q3 loss rises 3-fold YoY to ₹4,185 crore, gross NPA down at 29.67%, net NPA drops to 14.01%.

- PNB Q3 profit at ₹246.5 crore, NII rises 8% to ₹4,290 crores, GNPA fell to 16.33%.

- Tata Motors Q3 consolidated net loss at ₹26,961 crore, revenue at ₹77,001 crore.

- M&M consolidated profit up 60% at ₹1,476 crore, total income up 14% to ₹13,235 crore.

- Ashok Leyland Q3 profit falls 22% to ₹381 crore, revenue slips 12% YoY to ₹6,325 crore.

- MRF Q3 profit skids 18% to ₹279.26 crore, revenue rose to ₹4,033.76 crores.

- Tech Mahindra Q3 profit rises 13% QoQ to ₹1,203 crores, revenue grew 3.6% QoQ to ₹8,944 crores.

- Vodafone Idea Q3 loss widens to ₹5,004 crore, loses 35 million customers.

- SpiceJet Q3 profit tanks 77% YoY to ₹55 crore on sharp rise in aircraft fuel expenses.

- Tata Steel Q3 profit jumps 54% YoY to ₹1,753 crore, consolidated revenue up 23% to ₹41,220 crore.

- India Cements Q3 net profit at ₹3.13 crore down 79.46% YoY, net sales up 8.51% at ₹1,316.30 crore.

- Sun Pharma Q3 profit jumps fourfold to ₹1,242 crores, total sales rose 1.16% YoY to ₹7,656.71 crores.

| WORLD INDICES | |||||

|---|---|---|---|---|---|

| Indices | 28-Feb | 31-Jan | % 1M | 01-Jan | % since Jan |

| BSE | 35867 | 36257 | -1.07% | 36255 | -1.07% |

| NSE | 10793 | 10831 | -0.36% | 10910 | -1.08% |

| DOW | 25916 | 25000 | 3.67% | 23327 | 11.10% |

| NASDAQ | 7533 | 7282 | 3.44% | 6635 | 13.52% |

| FTSE | 7075 | 6969 | 1.52% | 6728 | 5.15% |

| Nikkei | 21385 | 20773 | 2.94% | 20015 | 6.85% |

| Hang Seng | 28633 | 27942 | 2.47% | 25846 | 10.79% |

| Straits Times | 3213 | 3190 | 0.71% | 3069 | 4.69% |

| Shanghai | 2941 | 2584 | 13.79% | 2494 | 17.93% |

| USD | 70.72 | 71.08 | -0.50% | 69.45 | 1.83% |

| Euro | 80.41 | 81.35 | -1.16% | 79.50 | 1.14% |

| GBP | 93.79 | 93.12 | 0.73% | 88.40 | 6.10% |

| Yen/100INR | 0.63 | 0.65 | -2.99% | 0.63 | -0.27% |

| Gold | 32981 | 33056 | -0.23% | 31422 | 4.96% |

| Silver | 39134 | 40439 | -3.23% | 38786 | 0.90% |

| Crude Brent $ | 66.03 | 61.89 | 6.69% | 53.50 | 23.42% |

| Crude Nymex $ | 57.45 | 53.73 | 6.92% | 45.31 | 26.79% |

| NIFTY SECTORAL INDICES | |||||

|---|---|---|---|---|---|

| Sectors | BANK NIFTY | CNX IT | CNX AUTO | CNX FMCG | CNX PHARMA |

| 28-Feb | 26790 | 15732 | 8355 | 29263 | 8885 |

| 31-Jan | 27295 | 15499 | 8218 | 29801 | 8825 |

| % 1M | -1.85% | 1.50% | 1.66% | -1.80% | 0.67% |

| 01-Jan | 27392 | 14451 | 9182 | 30398 | 8882 |

| % since Jan | -2.20% | 8.87% | -9.01% | -3.74% | 0.03% |

| INDIAN TRADE(USD MILLION) | |

|---|---|

| Exports | 26360 |

| Imports | 41090 |

| FDI | 2657 |

| Government Bond 10Y | 7.57% |

| GDP YoY | 6.60% |

| Inflation Rate | 2.05% |

| Forex Reserves $ M | 398270 |

| IIP % | 5.90% |

| INSTITUTIONAL TRADING ACTIVITY | ||

|---|---|---|

| Particulars | FII (Rs.crore) | MF (Rs.crore) |

| Equity | 14464 | 5679 |

| Debt | (5941) | 20124 |

| Total 1 M | 8523 | 25803 |

| Total Since Jan | 5418 | 87032 |

| Equity | 13959 | 12221 |

| Debt | (8542) | 74812 |

Sorry, the comment form is closed at this time.