Dear Colleagues,

I am pleased to attach the Economy / Market Snapshot covering all the major events in January, 2017.

New Year 2017 started very well for the Indian markets; Markets went up by 4% last month. Banks, Auto and FMCG sectors did exceptionally well while IT and Pharma were down. Actions by the new US Government led by Donald Trump erased several thousand of crores of market cap of IT Companies. FII’s were net sellers in the equity market to the extent of Rs.785 crores and in the debt market to the extent of Rs.3,660 crores; Domestic Mutual Funds were net buyers in the equity market to the extent of Rs.5,180 crores and in the debt market to the extent of Rs.29,650 crores.

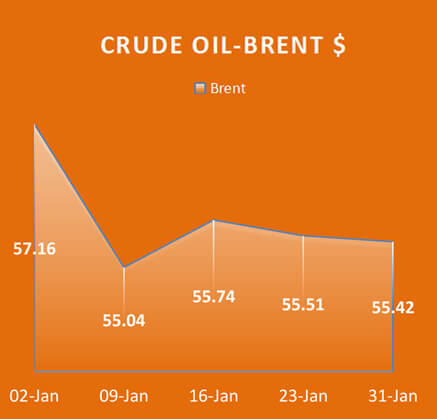

Global markets went up with Nasdaq gaining over 4% and Hong Kong gaining over 6%. UK and Japan markets were marginally negative while Dow and China moved up marginally; Indian Rupee continue to hover around Rs.68 mark. Gold went up by 5% while Silver went up by 7%.Crude came down by 2%.

As I write this message, our Finance Minister, Mr Arun Jaitley is presenting the budget in the Parliament. With the uncertainty of actions of Donald Trump in the US, the after effects of demonetization drive, fears of slowdown in economy, the Budget is a major event which can throw light on the government’s preparedness and action to face these challenges. Let us hope to get some positive and good news from the Budget.

Happy reading!

Regards

V Murali

General News

- Election Commission announces the poll dates for 5 states – UP, Punjab, Uttarakhand, Goa and

Manipur. - Uttar Pradesh to vote in 7 phases, from Feb 11 to March 8, Goa, Punjab on Feb 4, Uttarakhand on Feb

15 and Manipur on March 4, 8. - Counting for all states will be held on March 11.

- EC gave its nod to the centre to present the Union Budget 2017 on 1 February ahead of the assembly

elections, but bars state-specific announcements. - RBI removes withdrawal limit on current and overdraft accounts and from ATMs.

- Restrictions on withdrawal of Rs 24,000 a week from savings bank account to continue.

- India celebrated its 68th Republic Day and Crown Prince of Abu Dhabi Sheikh Mohammed bin Zayed

was the Chief Guest this year. - Donald Trump took the oath of office as the President of the United States.

- Trump signed first order on Affordable Care Act, to follow new rule: buy American and hire American.

- Trump’s executive orders on immigration policy and Mexico wall sparked protests.

- H1B visa reform bill introduced in US, minimum pay doubled to $130,000.

- UK government loses Brexit legal challenge as the Supreme Court says Government must seek parliamentary approval.

- RBI Governor Urjit Patel appeared before Parliament panel to brief on demonetisation.

- Patel told the panel that the situation in urban areas was almost normal, and efforts were on to

improve the cash flow to rural and remote areas in the country. - Akhilesh Yadav won the rights to use party name and symbol after a feud in the Samajwadi Party.

- SP joins hands with Congress to contest the elections.

- Jallikattu ban saw massive state-wide protests by youth in Tamil Nadu.

- TN government passed ordinance to conduct Jallikattu.

- Congress names Amarinder Singh as Punjab CM candidate.

- Mumbai: Congress and NCP tie-up for polls to 5 Maharastra Council seats next month.

- Justice Jagdish Singh Khehar sworn in as 44th Chief Justice of India.

- Delhi Police commissioner Alok Kumar Verma appointed as the director of the CBI.

- PM Modi inaugurated the 8th Vibrant Gujarat Summit in Gandhinagar.

- India successfully test fired Agni-IV ballistic missile.

- SC dismissed plea for CBI probe into Jayalalithaa’s death.

- Sahara diaries: SC rejected plea for SIT probe against PM, others.

- Haj application process goes digital, mobile app launched.

- Pakistan handed over dossier on India’s interference to the new UN Secretary General.

- Australia, Malaysia, China halt the missing Malaysian Airlines MH370 underwater search.

- Pakistan test-fires 1st nuclear-capable submarine cruise missile; Rajasthan on alert after inputs of

possible intrusion from Pakistan. - South Korean court formally starts Park Geun-hye’s impeachment trial.

- Barkha Dutt quits NDTV after 21 years, likely to start own venture.

- Salman Khan acquitted by Jodhpur court in illegal firearms case.

- MS Dhoni stepped down as India’s limited-overs skipper, Virat Kohli named captain.

- India vs England: India won the ODI series 2-1. India and England won 1 match each in the 3 T20I

series. - Australian Open: Roger Federer won the men’s singles title while Serena Williams won the women’s

title. - Sania Mirza and Ivan Dodig end runner-up at Australian Open mixed doubles final.

- Bangladesh vs New Zealand: NZ wins the T20I and Test series.

- Saina Nehwal wins the Malaysia Grand Prix Gold, while PV Sindhu and Sameer Verma win the Syed

Modi GPG titles. - SC removes Anurag Thakur as BCCI President and Ajay Shirke as Secretary.

- SC appoints Vinod Rai to head BCCI; nominates Rai, Ramachandra Guha, Vikram Limaye and Diana

Edulji as administrators. - Cristiano Ronaldo wins the FIFA best player award for the fourth time.

- FIFA council approves 48-team World Cup for 2026 edition.

Business News

- Economic Survey 2017 tabled in Parliament, FY18 GDP growth seen at 6.75-7.5%.

- TCS CEO N. Chandrasekaran appointed as Tata Sons chairman.

- Rajesh Gopinathan named as new TCS CEO and MD.

- RBI Governor Urjit Patel urges government to be mindful of debt levels.

- BSE’s Rs 1,230 crore IPO was oversubscribed nearly 12 times.

- SBI eyes to raise $1.5 billion capital next fiscal: Arundhati Bhattacharya.

- Government imposes anti-dumping duties on some steel products imported from China and European nations.

- Demonetisation effects in India to disappear in medium term: World Bank.

- WB CM Mamata Banerjee promised a friendly environment to industrialists at the 2-day Bengal

- Global Business Summit. R P Sanjiv Goenka Group and Bharti Enterprises announce an investment

commitment of upto Rs 14,000 crores at the Bengal summit. - HDFC Bank Sheds 4,500 employees in Q3, indicates that future hiring pace could slow.

- Cabinet clears insurance reforms, 5 government insurers to get listed.

- Vodafone in talks with Idea cellular for Indian merger.

- Airtel accuses TRAI of being mute spectator to extension of Jio free services.

- TRAI seeks Attorney General’s opinion on Reliance Jio’s tariff plans.

- RIL plans to invest another Rs. 30,000 crore into Jio Infocomm.

- Apple team meets inter-ministerial group for setting up a manufacturing unit in the country.

- Post Verizon deal, Yahoo to be named as Altaba and CEO Marissa Mayer to quit the board.

- Toshiba approves plan to sell 20% of core memory chip business.

- Tata Motors unveils smart buses powered by green technology.

- Ford scraps a planned Mexican car factory, adds 700 jobs in Michigan after Donald Trump’s criticism.

- Hero Cycles opens global design centre in Manchester at an investment of 2 million pounds.

- McDonald’s sells most of its China and Hong Kong businesses for $2.1 billion.

- Future Group partners with Cognizant for its FMCG arm Future Consumer Ltd (FCL).

- America’s largest department store chain, Macy’s to shut down 68 stores and lay off 10,000 employees.

- Alibaba CEO Jack Ma meets with Trump, pledges to create 1 million US jobs.

- Paytm transfers its wallet business to Payments Bank.

- IndiaPost becomes 3rd entity to receive licence to start payment bank operations.

- SEBI relaxes rules for angel funds to boost start-up funding.

- US forces India at WTO to open $1 billion solar market.

- WPI inflation rises 3.39% in December.

- India’s richest 1% hold 58% of the country’s total wealth: Oxfam report.

- India slips to 92nd rank on global talent competitiveness.

- Note ban squeezed gold demand to 650-750 tonnes, smuggling declined: World Gold Council.

- Patanjali biggest disruptive force in FMCG space: Report.

- 30 Indian-origin people feature in the 2017 edition of Forbes’ list of super achievers under age of 30.

- IMF warns Greece debt to be explosive in long term, requires a more credible debt relief plan from Europe.

- Mallya loan default case: Ex-IDBI Bank chairman among 9 held.

BJP alleged ex PM Manmohan Singh and P Chidambaram helped Mallya get loans. - Samsung’s Lee Jae-yong appeared for questioning in bribery probe but walks free as South Korean court dismisses arrest warrant.

- Starbucks nominates Satya Nadella and two others to its Board of Directors.

- Pakistan Finance Minister directs the State Bank of Pakistan to repay $500 million loan to China.

- A consortium led by Chinese firms acquires strategic 40% stake in Pakistani stock exchange.

- Facebook gets over 6,000 data requests from Indian government agencies in the first half of 2016.

- Snapdeal launches Cash@Home service which delivers Rs 2,000 at the doorstep.

- Pakistan lifts undeclared ban on Indian cotton imports.

- US Fed raises key interest rate by 0.25%.

- Online travel firm Yatra was listed on Nasdaq.

Q3 Results

- Kotak Mahindra Bank reports 38.6% jump in Q3 net profit at Rs 880 crores, NII up by 16.1%

- ICICI Bank’s Q3 profit falls 19% YoY to Rs 2,441.82 crores, NII declines 1.6% to Rs 5,363.35 crores.

- HDFC Bank reports 15.15% jump in Q3 profit at Rs 3,865.33 Cr, NII up 17.55% to Rs 8,309.09 Cr crores.

- Axis Bank Q3 profit tanks 73.3% YoY to Rs Rs 579.6 Cr, NII rises by 4.1% to Rs 4,333.73 Cr

- Yes Bank Q3 profit rises 30.6% to Rs 882.6 crores, NII up by 30.2% YoY to Rs 1,507 crores.

- Canara Bank Q3 profit jumps nearly 4-fold, increases 279% to Rs 322 crores, NII up by 8.4%

- HDFC reports 12% rise in standalone profit to Rs 1,701 Cr, interest earned rises to Rs 8,133.78 Cr.

- LIC Housing Finance reports 19.18 % YoY jump in Q3 net profit to Rs 499.26 crores.

- Infosys Q3 Net profit rises 2.8% QoQ to Rs 3,708 crores, rupee revenue slips 0.2% to Rs 17,273 crores.

- FY17 USD revenue guidance lowered to 7.2% – 7.6% and rupee revenue guidance to 10% – 10.4%.

- HCL Tech reports 2.3% rise in net profit at Rs 2,062.04 Cr, revenue jumps 2.56% to Rs 11,814.20 Cr TCS

- Q3 profit rises 2.9% QoQ to Rs 6,778 crores, revenue increases 1.5% to Rs 29,735 crores.

- Tech Mahindra reports consolidated net profit at Rs 845 crores, adds 12 clients during the quarter.

- Dollar revenue is up by 4.1% to $1,116.1 million and rupee revenue by 5.4% to Rs 7,557.5 crores.

- Wipro reports 1.80% QoQ rise in net profit at Rs 2,109.60 crores, rupee revenue at Rs 13,196 crores.

- Reliance Q3 profit rises 4.1% to Rs 8022 crores, Gross refining margin (GRM) at $10.80/bbl.

- HUL reports 7% YoY growth in net profit to Rs 1,038 crores, EBITDA slips 5.2% at Rs 1355.4 crores.

- ITC Q3 net profit rises 5.7% YoY to Rs 2,646.73 crore and total income by 4.6% to Rs 13,569.97 crore.

- TVS Motor Q3 profit grew 10.4% to Rs 132.67 crores, revenue increases 2.8% to Rs 3,239.55 crores.

- Maruti Suzuki posts 47.46% rise in net profit at Rs 1,744.50 Cr, Net sales up 12.4% to Rs 16,623.6 Cr

- Biocon’s Q3 consolidated net profit jumps 64.6% to Rs 171.3 Cr; total income up 29.4% at Rs 1,044 Cr

- L&T Q3 profit up 39% to Rs 972.4 crore, cuts FY17 revenue growth guidance to 10%.

Market News

- Indian markets went up by 4% last month; IT Sector hard hit; Banks, Auto and FMCG done well

- FII’s net settlers in the market while domestic institutions were buyers in the market

- Global markets up; Gold and Silver up; Crude down

| WORLD INDICES | |||||

|---|---|---|---|---|---|

| Indices | 31-Jan | 30-Dec | % 1M | 02- Jan | % since Jan |

| BSE | 27656 | 26626 | 3.87% | 26,595 | 3.99% |

| NSE | 8561 | 8186 | 4.59% | 8,180 | 4.67% |

| DOW | 19864 | 19763 | 0.51% | 19,763 | 0.51% |

| NASDAQ | 5615 | 5383 | 4.30% | 5,383 | 4.30% |

| FTSE | 7099 | 7143 | -0.61% | 7,143 | 0.61% |

| Nikkei | 19041 | 19114 | -0.38% | 19,114 | -0.38% |

| Hang Seng | 23361 | 22001 | 6.18% | 22,001 | 6.18% |

| Straits Times | 3047 | 2881 | 5.76% | 2,881 | 5.76% |

| Shanghai | 3159 | 3104 | 1.79% | 3,104 | 1.79% |

| USD | 67.86 | 67.92 | -0.09% | 68.22 | -0.53% |

| Euro | 72.82 | 71.43 | 1.95% | 71.32 | 2.10% |

| GBP | 84.83 | 83.84 | 1.18% | 83.70 | 1.35% |

| Yen/100INR | 0.60 | 0.58 | 3.23% | 0.58 | 3.25% |

| Gold | 28942 | 27445 | 5.45% | 27,570 | 4.98% |

| Silver | 41911 | 39049 | 7.33% | 39,136 | 7.09% |

| Crude Brent $ | 55.42 | 56.76 | -2.37% | 57.16 | -3.04% |

| Crude Nymex $ | 52.71 | 53.90 | -2.20% | 54.05 | -2.48% |

| NIFTY SECTORAL INDICES | |||||

|---|---|---|---|---|---|

| Sectors | BANK NIFTY | CNX IT | CNX AUTO | CNX FMCG | CNX PHARMA |

| 31-Jan | 19515 | 9849 | 9838 | 21833 | 10236 |

| 30-Dec | 18177 | 10399 | 9142 | 20754 | 10267 |

| % 1M | 7.36% | -5.30% | 7.61% | 5.20% | -0.30% |

| 02-Jan | 17970 | 10367 | 9327 | 20710 | 10310 |

| % since Jan | 8.60% | -5.00% | 5.48% | 5.42% | -0.72% |

| INDIAN TRADE( USD MILLION) | |

|---|---|

| Exports | 23885 |

| Imports | 34254 |

| FDI | 2043 |

| Government Bond 10Y | 6.41% |

| GDP YoY | 7.30% |

| Inflation Rate | 3.41% |

| Forex Reserves $ M | 360780 |

| IIP % | -1.29% |

| INSTITUTIONAL TRADING ACTIVITY | ||

|---|---|---|

| Particulars | FII (Rs.crore) | MF (Rs.crore) |

| Equity | -725 | 5180 |

| Debt | -3660 | 29653 |

| Total 1 M | -4385 | 34834 |

| Total Since Jan | -4385 | 34834 |

| Equity | -725 | 5180 |

| Debt | -3660 | 29653 |

Sorry, the comment form is closed at this time.