Dear Colleagues

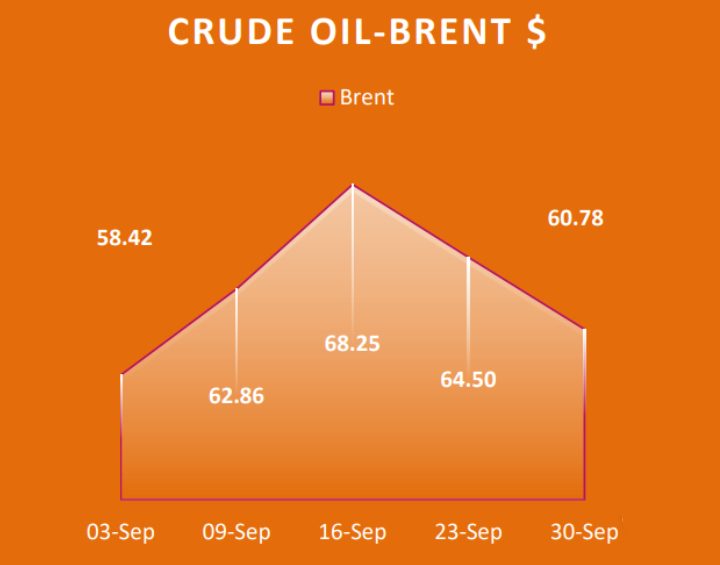

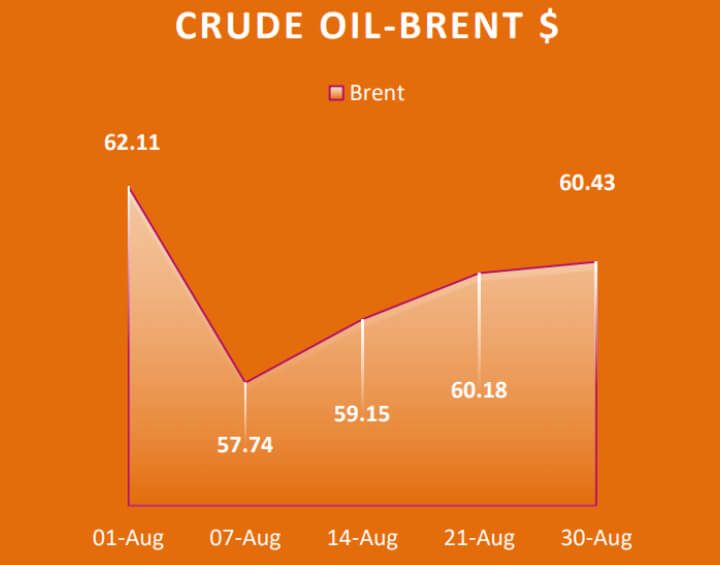

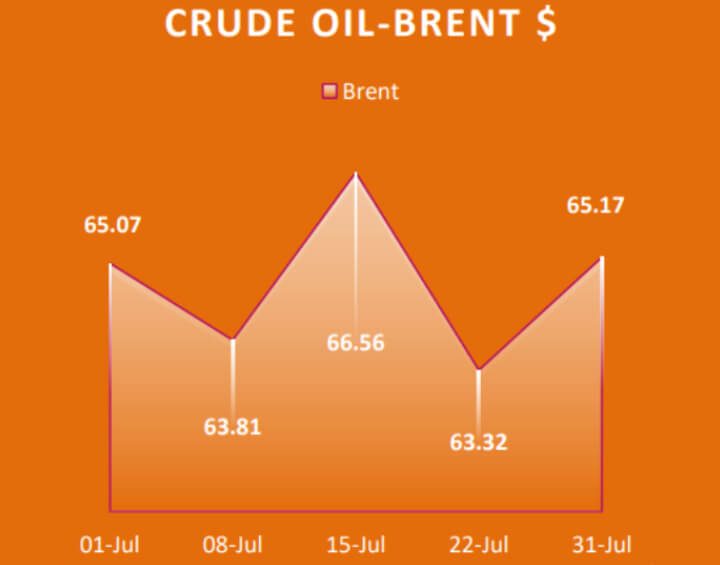

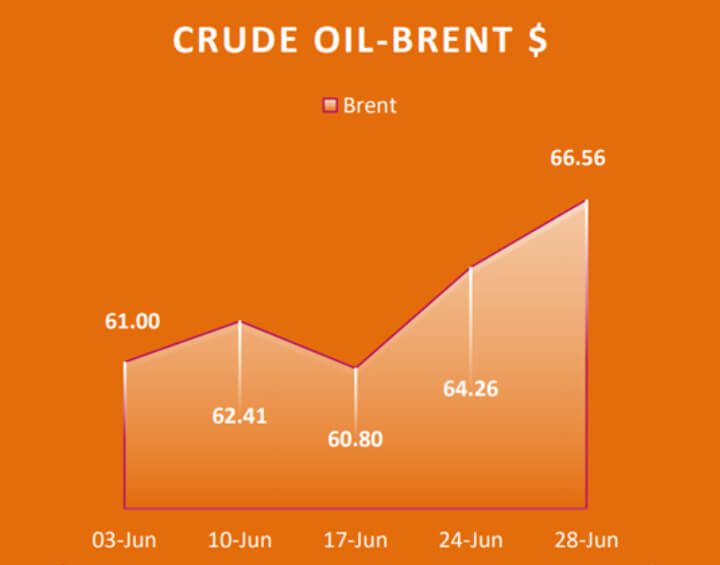

I am pleased to attach the Economy / Market Snapshot covering all the major events in September, 2019

Indian Markets registered a gain of 4% last month after the announcement of several measures including reduction of corporate tax by the Finance Minister.BSE could regain the levels of 39,000 again.

Read more